- LIFESTYLE

- FASHION

- FOOD

- ENTERTAINMENT

- EVENTS

- CULTURE

- VIDEOS

- WEB STORIES

- GALLERIES

- GADGETS

- CAR & BIKE

- SOCIETY

- TRAVEL

- NORTH EAST

- INDULGE CONNECT

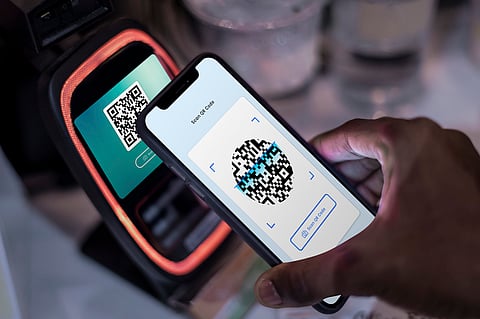

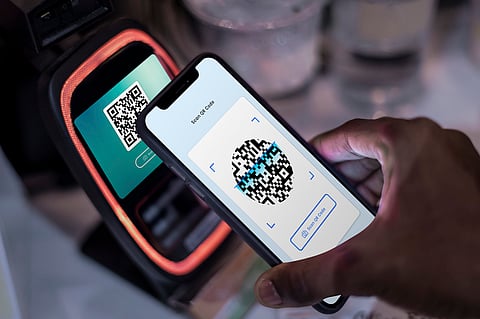

Indian travellers can now utilise the Unified Payments Interface (UPI) for transactions in Malaysia, offering a significant boost to digital payment convenience. While the this Asian nation becomes the latest edition to the rapidly growing list, the integration of India's UPI with the Malaysian payment ecosystem is a result of a major partnership to enable seamless cross-border payments.

UPI's international expansion is a game-changer for Indian travellers, offering a convenient and familiar way to pay abroad. Here is a breakdown of countries where Indians can currently use UPI for merchant payments and those where UPI will soon be available based on recent announcements and partnerships.

Bhutan was the first country to adopt UPI standards. Nepal integrated the local Fonepay network for merchant payments. The United Arab Emirates (UAE) accepted UPI at merchant terminals, especially in major retail and tourist spots. Singapore, linked with their national system, PayNow, enabled P2P (person-to-person) and P2M (person-to-merchant) transfers.

France became the first European country, with initial acceptance at locations like the Eiffel Tower and major retail chains. Island nations surrounding the India, Sri Lanka and Mauritius launched services jointly alongside RuPay card acceptance. Most recently, Qatar adopted for QR scan code payments at select merchants.

Countries that will soon adopt/enable UPI

UPI's international arm (NIPL) has signed agreements and is in various stages of integration with the several regions and countries expected to go live soon. Japan is already in an agreement to enable UPI acceptance for Indian tourists at select merchants. Discussions are underway in Thailand to link UPI with their national payment system, PromptPay, for cross-border transactions.

Partnerships with companies like Worldline SA aim to enable UPI acceptance at Point-of-Sale (POS) terminals in several countries, including Belgium, Netherlands, Luxembourg and Switzerland. Part of NIPL's plan to expand into the Southeast Asia region, Vietnam may soon make this facility available. Discussions and MoUs have been signed with Philippines for collaboration in the digital payment space.

Saudi Arabia is also set to introduce UPI is a priority area in the bilateral Fintech collaboration discussions. United States are in talks regarding a payment corridor between UPI and the US real-time payment system (IXB). Preliminary discussions or MoUs have been reported with countries like Australia, Bahrain, Cyprus, Oman and others.

Note for Travellers

Even in countries where UPI is live, always check with your bank or UPI app provider before traveling to ensure if your specific UPI app supports 'UPI International' transactions, that you have activated the international payment service (often for a 1 to 90-day period) and that you are aware of any potential Forex markups or transaction fees charged by your bank or payment service.

For more updates, join/follow our WhatsApp, Telegram and YouTube channels